Uniswap price today.

Get information about the price of Uniswap so you can make better buying or selling decisions

How the value of Uniswap evolves

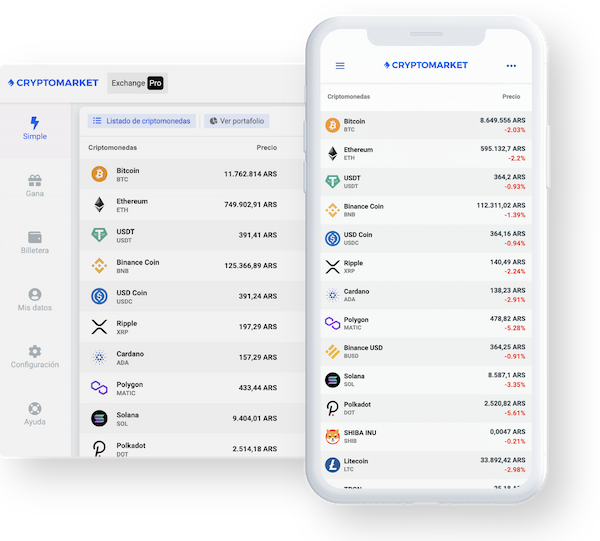

Uniswap's goal is to keep token automated trading completely open for all cryptocurrency holders while simultaneously aiming to enhance the efficiency of trading operations compared to traditional exchange platforms. UNI is poised for substantial growth prospects thanks to the surge in decentralized finance (DeFi) and the consequent increase in token trading value. You can quote, buy, and follow UNI's price on our platform, Cryptomkt.

What is Uniswap?

Uniswap (UNI) is a decentralized exchange protocol that has gained significant attention for its unique operating system, which allows for the exchange of different cryptocurrencies using smart contracts on the Ethereum network. The total supply of the governance token UNI is 1 billion units, which will be distributed over four years. After this period, Uniswap will introduce a perpetual inflation rate of 2% to maintain engagement in the network.

3 reasons to choose Uniswap

1

Decentralized exchange protocol

Uniswap exchange is decentralized (DEX) that operates on the Ethereum blockchain, allowing users to swap tokens directly without needing a centralized intermediary. The protocol leverages smart contracts, enhancing transaction security and transparency.

2

Token pairs and automated liquidity

Uniswap utilizes token pairs, enabling users to exchange one token for another. It employs an automated liquidity system, meaning liquidity providers can deposit their tokens into the smart contract and receive a proportional share of the exchange fees generated within the protocol.

3

Exchange Fees

Uniswap charges a 0.3% exchange fee on each transaction conducted on its platform. These fees are paid in ETH and distributed to liquidity providers and UNI token holders as a reward for their participation in the protocol. If the demand for Uniswap's platform remains high, this could increase transaction volume and exchange fees, potentially raising UNI's value and price.